According to a recent report from the investment bank Goldman Sachs, home purchases are expected to plummet in the closing months of the year, and the recovery may not pick up speed until 2024.

At first glance, this is an alarming headline. What are we supposed to think about it? First of all, let’s take a deep breath and give this headline a little context by examining four slides that show how the Northern Virginia real estate market has performed over the last ten years.

Let’s also remember Goldman is talking about national averages, which include second home and vacation markets etc., and not just our local market.

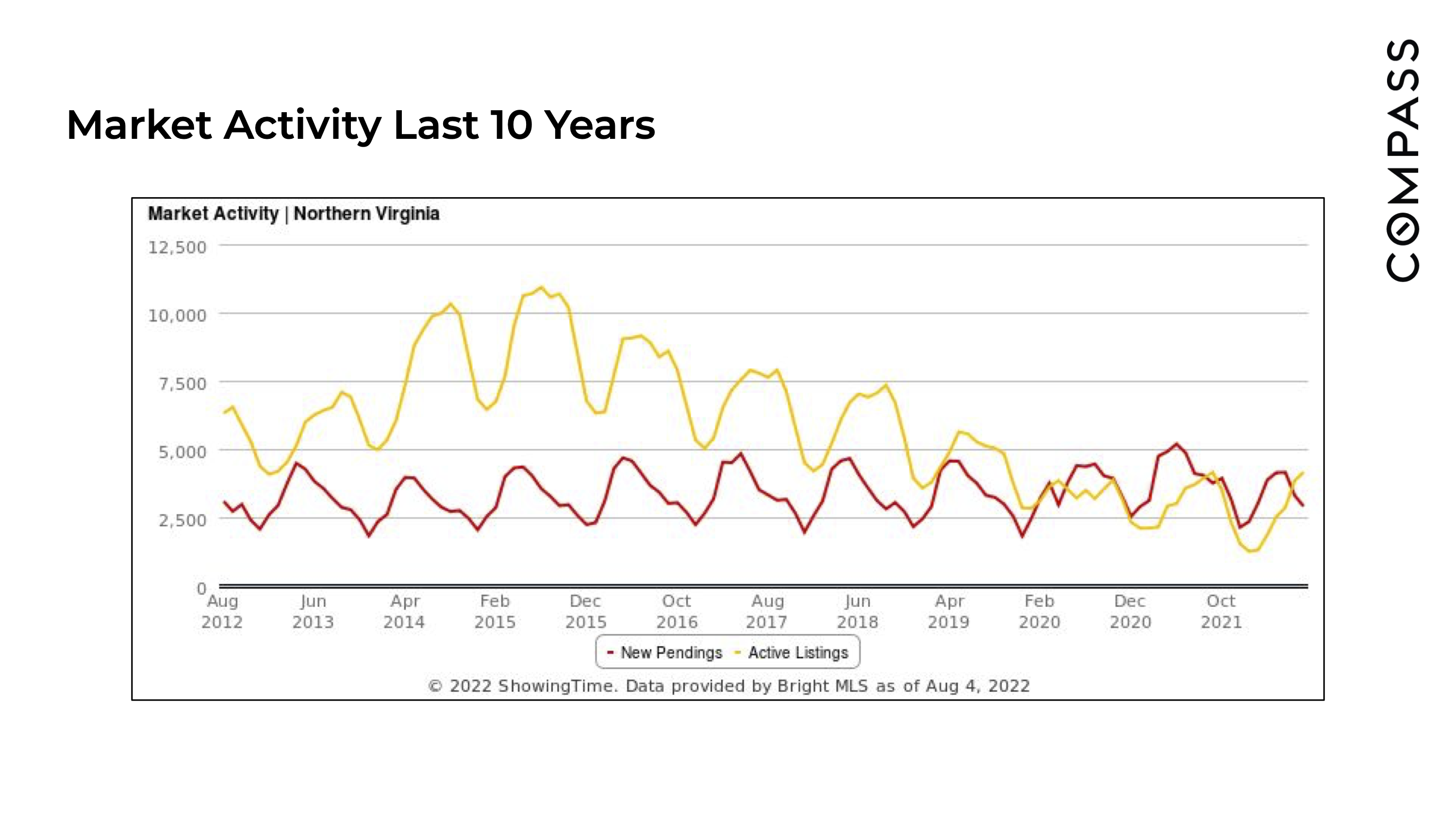

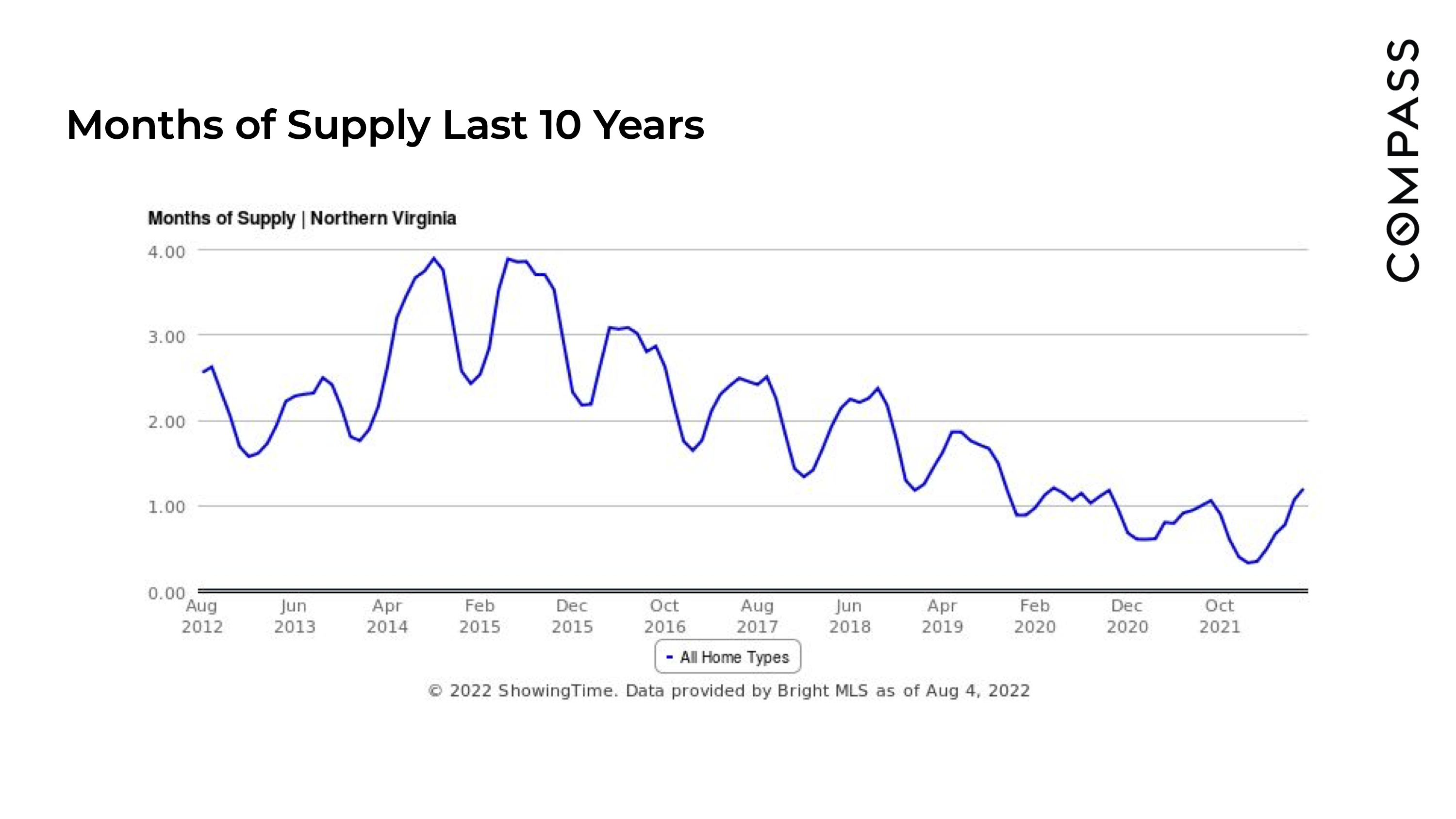

First up - let’s look at market activity.

This chart plots new pending sales (demand) along with active listings (supply). You’ll notice that each year follows the same pattern, with demand being relatively constant with a seasonal adjustment between 2,500 and 5,000 transactions. That’s right; demand for housing is relatively constant because the old circle of life drives it. You get a job, you get married, you get promoted, you have kids, you get divorced, you die, etc. etc. The cycle of life marches on no matter what the economy is doing, so it is more about demographics than anything else. It can be interrupted, and home purchases can be delayed, but eventually, life forces you to move forward. If rates are higher you move further out or buy a lower price point.

The big wild card in real estate is inventory, or how many houses are for sale. If the inventory is high, prices decline. If the inventory is low, prices increase. If it is a tie, prices tend to go up anyway due to inflation.

So why the surge in inventory from 2013 to 2015? The easy answer is as the market recovered from the crash of 2006-2008, it took time for sellers to reach the point where they could sell their homes again. So as equity improved, sellers could finally sell. The next major event was Covid, and inventory dropped quite a bit due to the pandemic.

Notice in the Covid years, the gaps between demand and supply essentially disappeared or went negative, which is why we saw prices increase so much. Too many buyers for not enough houses.

Ok, so what does this say about what Goldman is telling us? Is the market crashing? The answer is no. They are simply stating that demand is cooling due to higher interest rates, but unless inventory increases significantly, you aren’t going to see a market correction in price. Prices may level off, and we may not see much appreciation in 2023, but it should start to climb again in 2024.

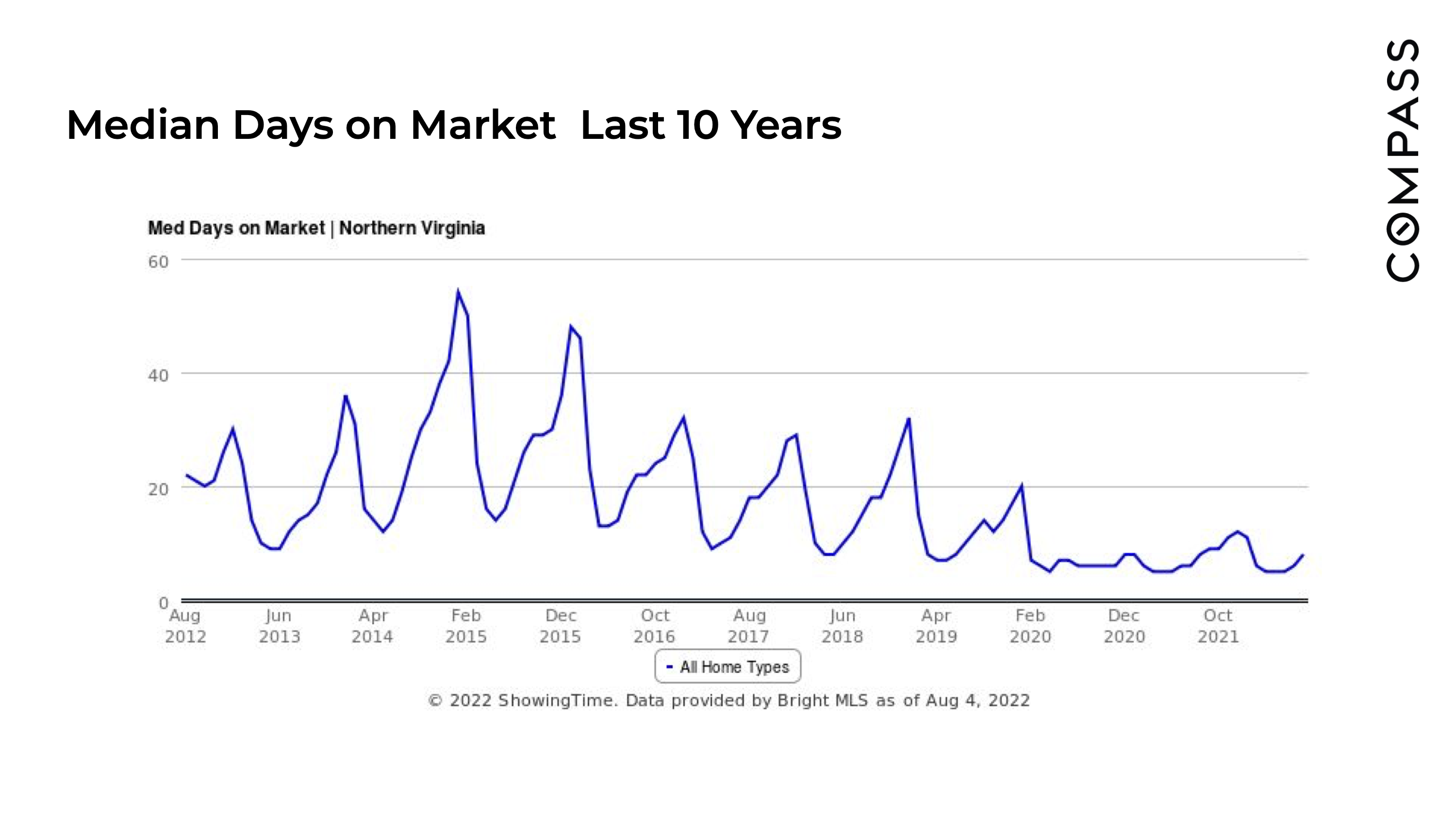

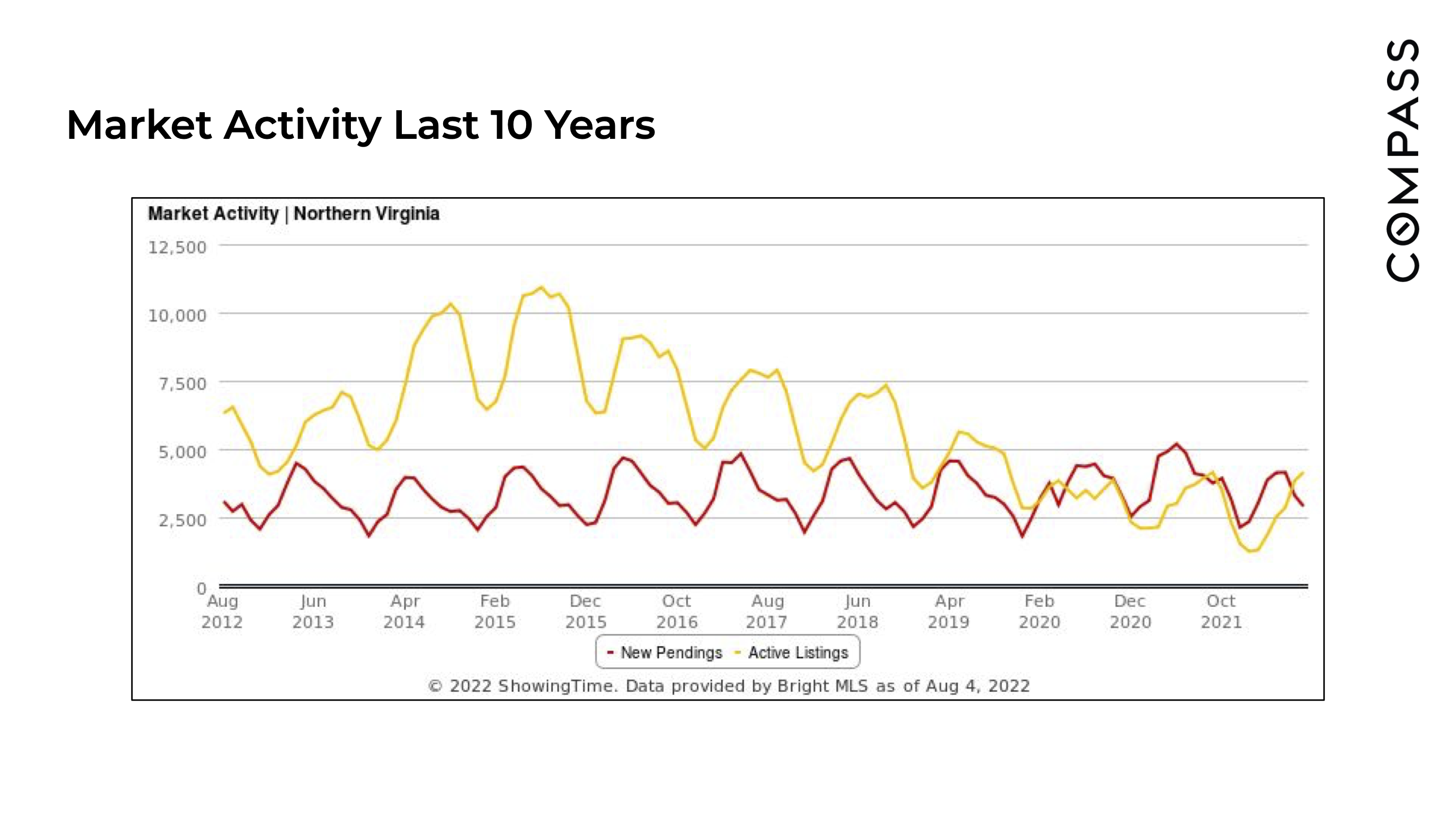

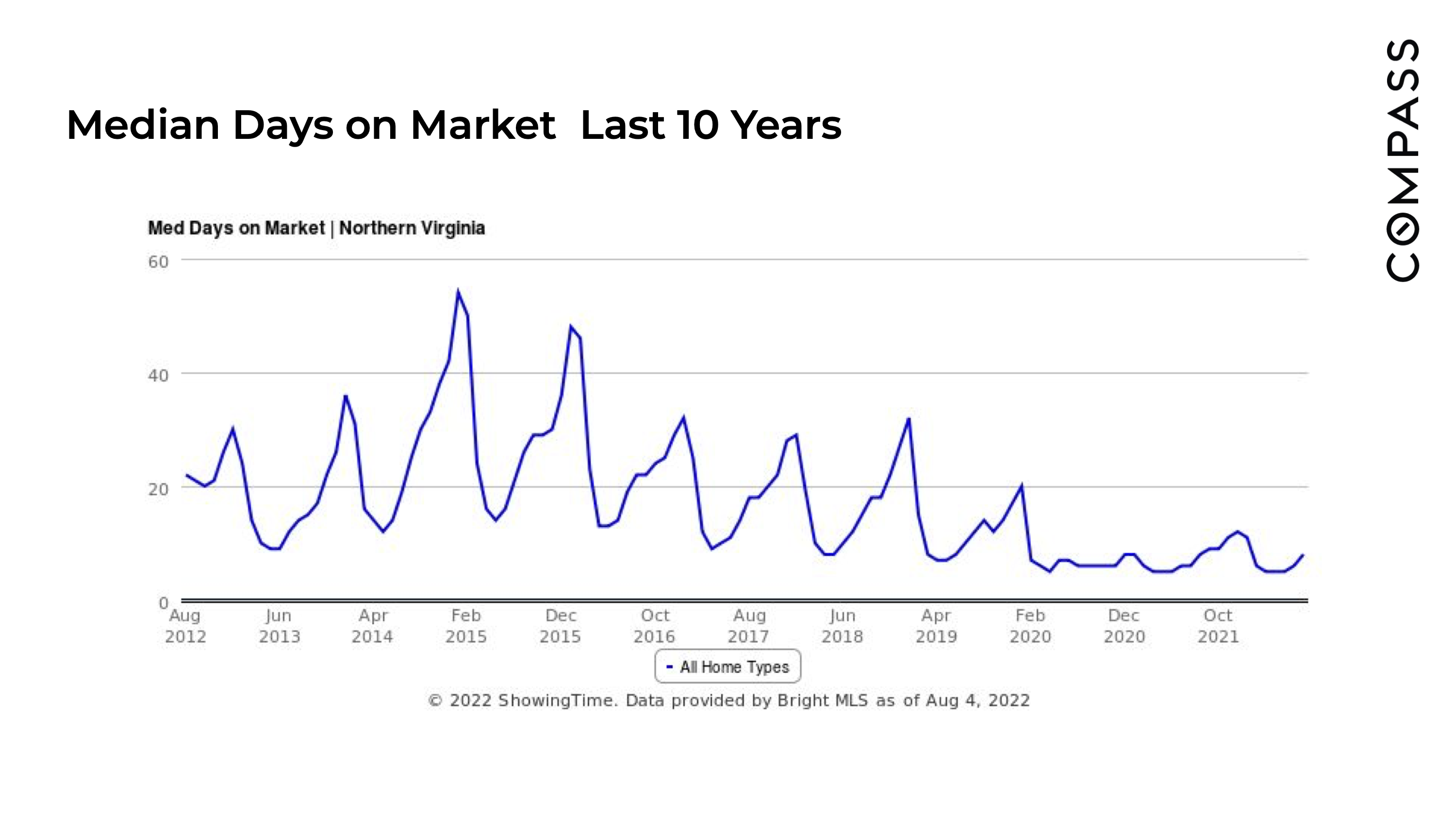

Let’s look at our next chart.

This one is just bonkers, showing median days on the market over the last ten years. In context, a neutral market between buyers and sellers is one with SIX MONTHS of inventory. When houses are selling in less than 30 days, it is very hard for inventory to increase given our historical demand curve. Think about that…if a house sells in under a month, do you think sellers will panic and drop prices? Probably not. Even if days on the market doubled from where we’ve been recently, houses would still be selling in two weeks! That's not a long time.

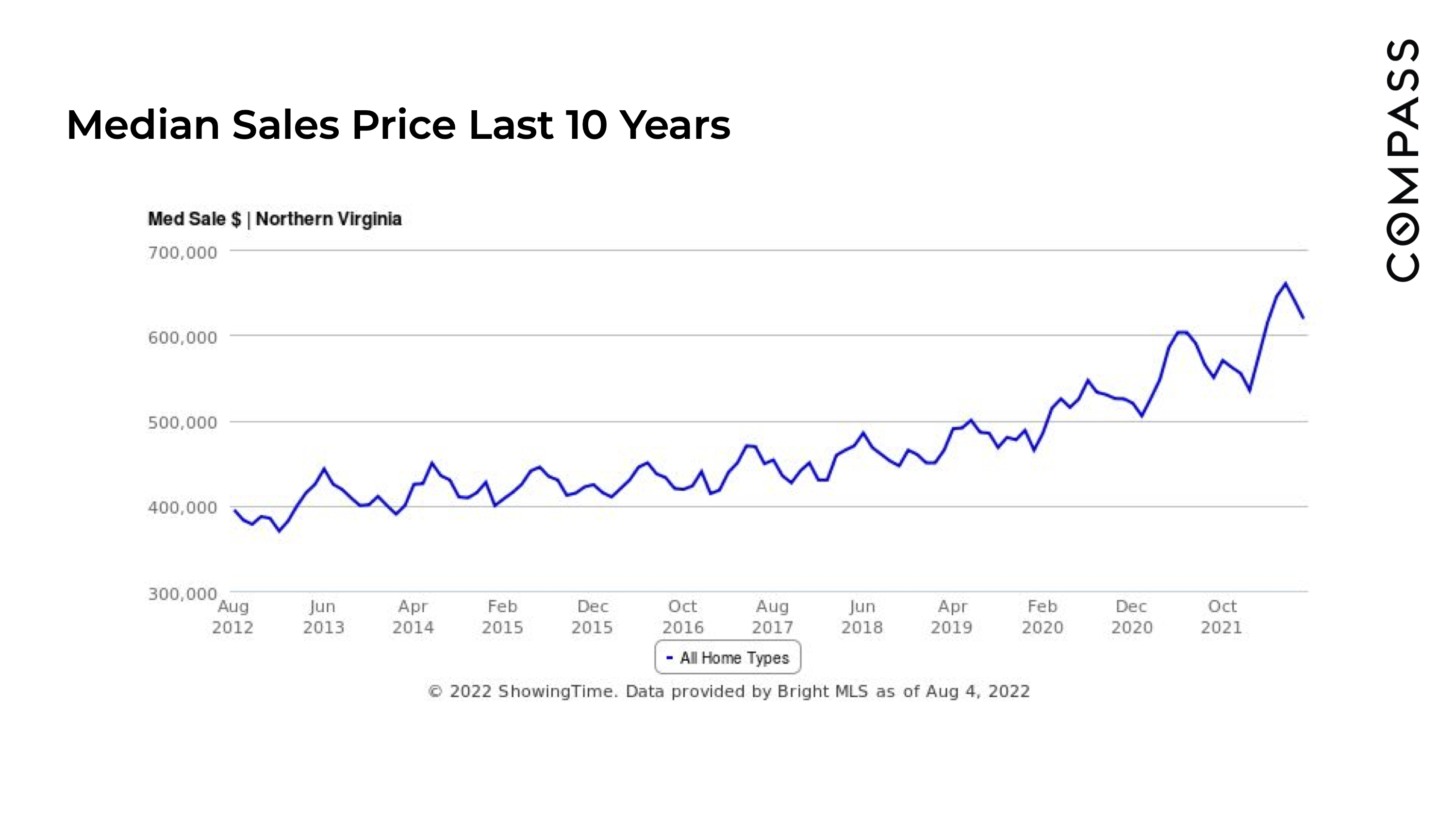

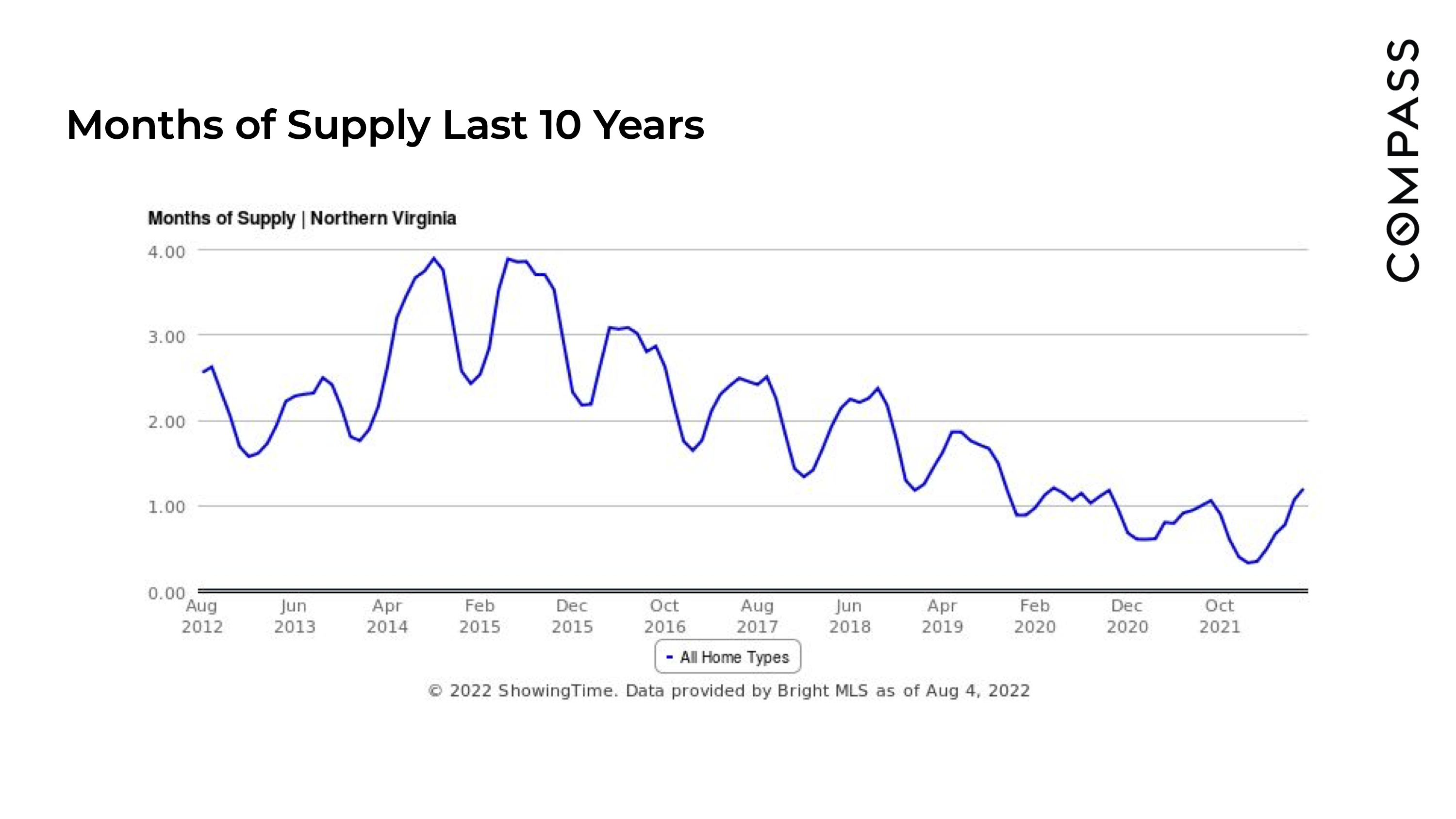

Let's look at supply over the last ten years. Again, just bonkers! The highest it ever reached was just under four months, which is still technically defined as a seller's market.

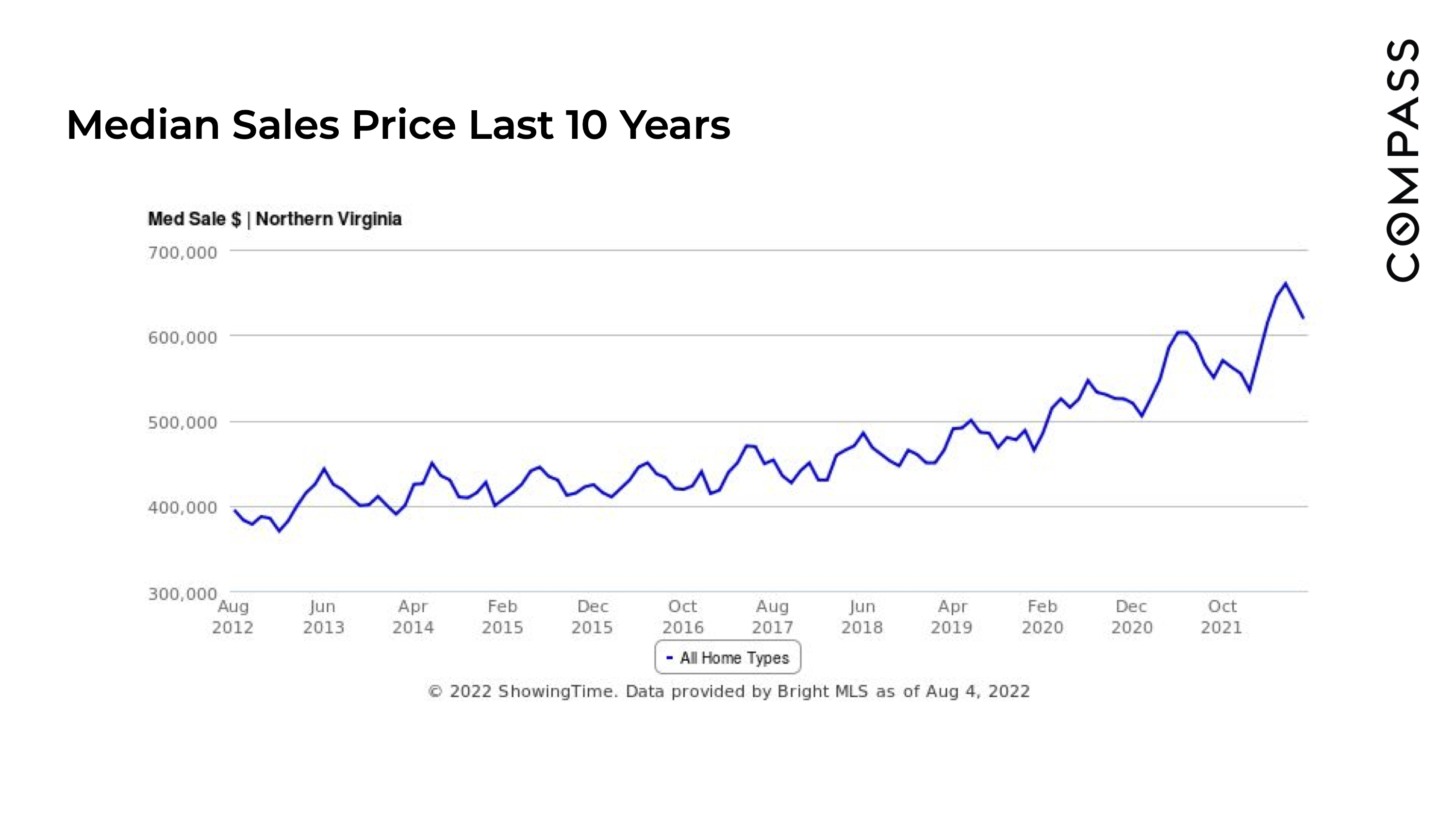

Want proof? Check out the next slide.

This is all you need to know when inventory is low. This is what you will see in the price curve. Even with cooling demand, you still aren’t going to see a collapse UNLESS there’s a spike in inventory. So yes, Goldman is correct; demand is cooling, but is inventory going to spike? Probably not in our area.

So here’s what you need to know. Demand is cooling. Inventory is not spiking. A collapse only comes when supply and demand are significantly out of balance. The market is returning to more normal conditions. So don’t let the headlines scare you. Life will go on. Peace!